ny paid family leave tax category

Beginning on January 1 2025 under the Time to Care Act of 2022 paid leave will be available to eligible Maryland employees for family leave medical leave and family military leave. Here are the key points.

Contract Forms Free Printable Documents Contract Contractor Contract Independent Contractor

Similar to Califorinias CASDI.

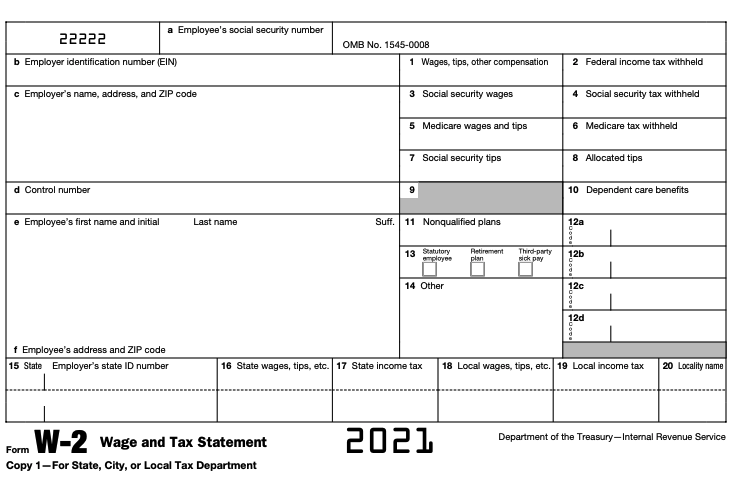

. New York Enacts Paid Family Leave Program. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2.

Paid Family Leave benefits are not subject to employee or employer FICA FUTA or SUTA. Your PFL benefits are taxable. Fully Funded by Employees.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax. August 29 2017. This deduction shows in Box 14 of the W2.

Year Duration Wage Replacement 2018 8 weeks 50 of the employees average weekly wage or 50 of the statewide average weekly wage whichever is less 2019 10 weeks 55 of the employees average weekly wage or 55 of the statewide. The Act covers the majority of employers in Maryland and is funded through a payroll tax that is scheduled to begin on. In 2021 the contribution is 0511 of an employees gross wages each pay period.

The New York State Department of Taxation and Finance DOTF issued much-needed guidance regarding the tax treatment of deductions from employee wages used to finance paid family leave premiums and the tax treatment of paid family leave benefits to be received by eligible employees. Part-time employees who work a regular schedule of less than 20 hours per week for a covered employer are eligible to take Paid Family Leave after working 175 days for their employer which do not need to be consecutive unless they qualify for and have executed a waiver. Part-time employees may be eligible for Paid Family Leave.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. The contribution remains at just over half of one percent of an employees gross wages each pay period. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service.

After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program. Paid Family Leave provides eligible employees job-protected paid time off to. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave.

New York paid family leave benefits are taxable contributions must be made on after-tax basis. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. Tax treatment of family leave contributions and benefits under the New York program.

The maximum annual contribution is 42371. Employees can request voluntary tax withholding. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14.

What category description should I choose for this box 14 entry. What category description should I choose for this box 14 entry. The maximum annual contribution for.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. The state begins requiring mandatory withholding beginning with checks dated on or after January 1 2018. Paid Family Leave Benefits available to employees as of.

NY Paid Family Leave Taxation Guidance Released. Like the California tax the program should add it to Schedule A taxes. Benefits paid to employees will be taxable non-wage income that must be included in.

Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. New York Paid Family Leave is insurance that may be funded by employees through payroll deductions. Paid Family Leave may also be available in some situations when an employee.

Paid Family Leave PFL benefits are considered a type of unemployment compensation and are taxable. Set up the NY. Confirm the clients state is NY.

Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. On August 25 2017 the New York State Department of Taxation and Finance DFS released highly anticipated guidance regarding taxation of PFL benefits and premium in Notice N-17-12. Not that anyone in New York needs it since theyre all over the 10000 SALT limit anyway.

New York Paid Family Leave is insurance that is funded by employees through payroll deductions. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Youll find answers to your top taxation questions below.

NYPFL in Box 14 of your W-2 should be listed under the category of Other deductible state or local tax when you are entering your W-2 on the federal screen. For the last couple of years NYS have being deducting premiums for the Paid Family Leave program. The NYPFL is a state-administered program that provides paid leave.

The New York Paid Family Leave NYPFL insurance tax requires New York employers to obtain an insurance policy or self-insured plan that is funded by employee contributions. Set the appropriate NY rates for Family Leave Rate and Family Leave Wage Base. Benefits paid to employees will be taxable non-wage income that must be included in federal gross income Taxes will not automatically be withheld from benefits.

The maximum annual contribution is 38534. Based upon this review and consultation we offer the following guidance. The benefit amount be included in federal gross income.

On the 2020 edition there is no Other option please see the screenshot above. Paid Family Leave benefits need to be reported on a 1099-Misc as taxable non-wage income. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

New York State Paid Family Leave Cornell University Division Of Human Resources

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

How Do State And Local Sales Taxes Work Tax Policy Center

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Paid Family Leave Expands In New York The Cpa Journal

Get Ready For New York Paid Family Leave In 2021 Sequoia

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

New York City Taxes A Quick Primer For Businesses

How To Read Your W 2 Justworks Help Center

Cost And Deductions Paid Family Leave

Paid Family Leave For Family Care Paid Family Leave

Where To Add Your Stimulus Money On Your Tax Return Taxact Blog

New York Paid Family Leave Updates For 2022 Paid Family Leave

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Whole Life Insurance Estate Planning Whole Life Insurance Life Insurance Premium Estate Planning